cryptocurrency tax calculator ireland

Basic rate 20 on earnings 12570 to 50270 if this is your main. READ NEXT - Calculator shows how much bills and tax will cost you from April 2022 The breaches may bolster regulators push for crackdowns in the space.

Crypto Tax Calculator Cryptotrader Tax

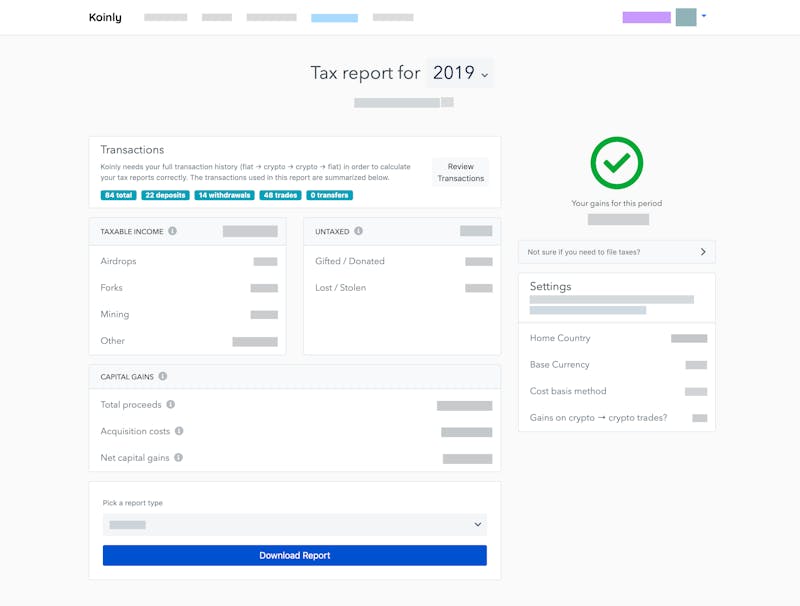

In the Tax Information tab you will find information about the tax treatment and the legal situation of cryptocurrencies in different countries.

. In most cases the IRS can audit you for three years after a filing but that time period extends to six years if the IRS suspects you made a substantial error on your return. One of the most beneficial and refundable tax credits for families with low or moderate incomes is the Earned Income Tax. For many Americans it can be difficult to know which tax credits they qualify for and why.

Claim missing stimulus up to 3200 per person for 2020 and 2021. The majority of such tools plug into wallets or cryptocurrency exchanges allowing users or their advisers to extract data into their own record-keeping systems via API feeds or CSV file transfers. The vulnerability has since been patched.

Payroll tax records including time sheets wages pension payments tax deposits benefits and tips must. In England Wales and Northern Ireland there are three tax bands. How is crypto tax calculated.

Union Finance Minister Nirmala Sitharaman has announced that tax advantages would be extended for another year till March 31 2023 in a. Best Tax Software Of 2022 Best Tax Software For The Self-Employed 2021-2022 Tax Brackets Income Tax Calculator Capital Gains Tax Calculator Credit Score. Self-employed.

Smart Simple and Secure. Business Tax Returns and supporting records must be kept until the IRS can no longer audit your return. But tax credits are worth having because they provide meaningful savings on a filers overall tax contribution and in some cases lead to an increased tax refund.

A plethora of software has arrived to fill the void with market leaders including Koinly Coin Tracking Crypto Tax Calculator Accointing and BitcoinTaxes. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. Crypto Tax Consultants and Tax Information Our CPA list contains tax consultants with cryptocurrency experience.

With Expatfiles DIY Tax Software US expats can now e-File their own Expat Tax return in as quick as 10 minutes. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. They can help you to check your tax return and file it correctly.

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick

Cryptocurrency Tax Calculator For Ireland Revenue Commissioners Koinly

Cryptocurrency Tax Calculator For Ireland Revenue Commissioners Koinly

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

How To Calculate Crypto Taxes Koinly

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

Ireland Cryptocurrency Tax Guide 2021 Koinly

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

Ireland Cryptocurrency Tax Guide 2021 Koinly

Crypto Tax Calculator Doing Your Crypto Taxes Has Never Been Easier Boinnex

Calculating Your Crypto Taxes What You Need To Know

Ireland Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Koinly Review Mar 2022 Cryptocurrency Tax Made Easy Yore Oyster

Crypto Tax Calculator Cryptocurrency And Nft Tax Software Review

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

How To Calculate Costs Basis In Crypto Bitcoin Koinly

Cryptocurrency Taxes In Australia 2021 2022 Guide Cointracker