how much is my paycheck after taxes nj

New Jersey Salary Paycheck Calculator. Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay.

New Jersey State Taxes 2021 Income And Sales Tax Rates Bankrate

How much is my paycheck after taxes nj Wednesday May 25 2022 Edit.

. How Much Tax Is Taken Out Of My Paycheck New Jersey. The result is that the FICA taxes you pay are. It can also be used to help fill steps 3 and 4 of a W-4 form.

New Jersey Hourly Paycheck Calculator. Calculate your New Jersey net pay or take home pay by entering your per-period or annual. New Yorks income tax rates.

New Jersey Paycheck Quick Facts. For example in the tax. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Up to 10000 its 39. Federal payroll taxes in New Jersey. Federal income tax FIT FIT is paid by employees via payroll deductions.

How much tax is taken out of a 500 check. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. File and Pay Employer Payroll Taxes Including 1099.

TOP 5 Tips Overview of New Jersey Taxes. There are eight tax brackets that vary based on income level and filing status. Just enter the wages tax withholdings and other information required.

Your average tax rate is. Commuter Transportation Benefit Limits. Divide your annual salary by 52 to calculate your gross weekly pay if your employer compensates you on a salary basis.

That means that your net pay will be 44566 per year or 3714 per month. If you make 2000 or less in taxable income you dont have to pay any state taxes. Up to 20000 its 48.

If you make 55000 a year living in the region of New Jersey USA you will be taxed 10434. Here are four federal payroll taxes that you will want to know about. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

Our calculator has recently been updated to include both the latest Federal. That means that your net pay will be 43041 per year or 3587 per month. Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state.

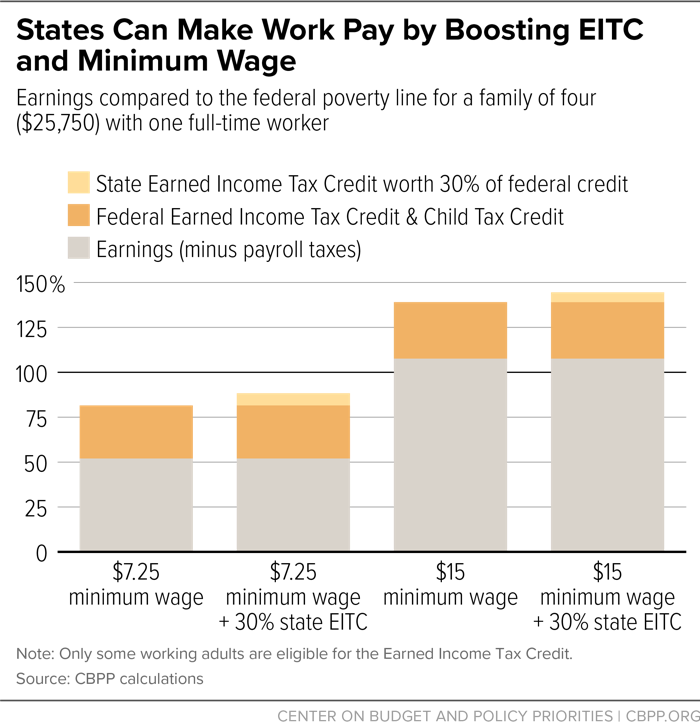

Employer Requirement to Notify Employees of Earned Income Tax Credit. You are able to use our New Jersey State Tax Calculator to calculate your total tax costs in the tax year 202223. New Jersey income tax rate.

Wealthier individuals pay higher tax rates than lower-income individuals. If you make between 2000 and 5000 the tax rate is 22. Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

How You Can Affect Your New Jersey. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Here S How Much Money You Take Home From A 75 000 Salary

Payroll Services In New Jersey Adp

Nj Div Of Taxation Nj Taxation Twitter

Interactive Map The High Low And In Between Of Nj S Property Taxes Nj Spotlight News

New Jersey Income Tax Calculator Smartasset

Interactive Map The High Low And In Between Of Nj S Property Taxes Nj Spotlight News

New Jersey Nj Tax Rate H R Block

2022 Tax Calendar Important Tax Due Dates And Deadlines Kiplinger

Phlebotomy Supervisor Salary In Newark Nj Comparably

New Jersey Salary Calculator 2022 Icalculator

Nj Division Of Taxation Trenton Nj

New Jersey What Is My State Taxpayer Id And Pin Taxjar Support

State Earned Income Tax Credits And Minimum Wages Work Best Together Center On Budget And Policy Priorities

State Income Tax Rates And Brackets 2022 Tax Foundation

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

The Official Website Of The Borough Of Wood Ridge Nj Tax Collector S Office

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

What Is An S Corp Reasonable Salary How To Pay Yourself The Right Way Collective Hub